What do Current Economic Conditions mean for Home Buyers and Sellers?

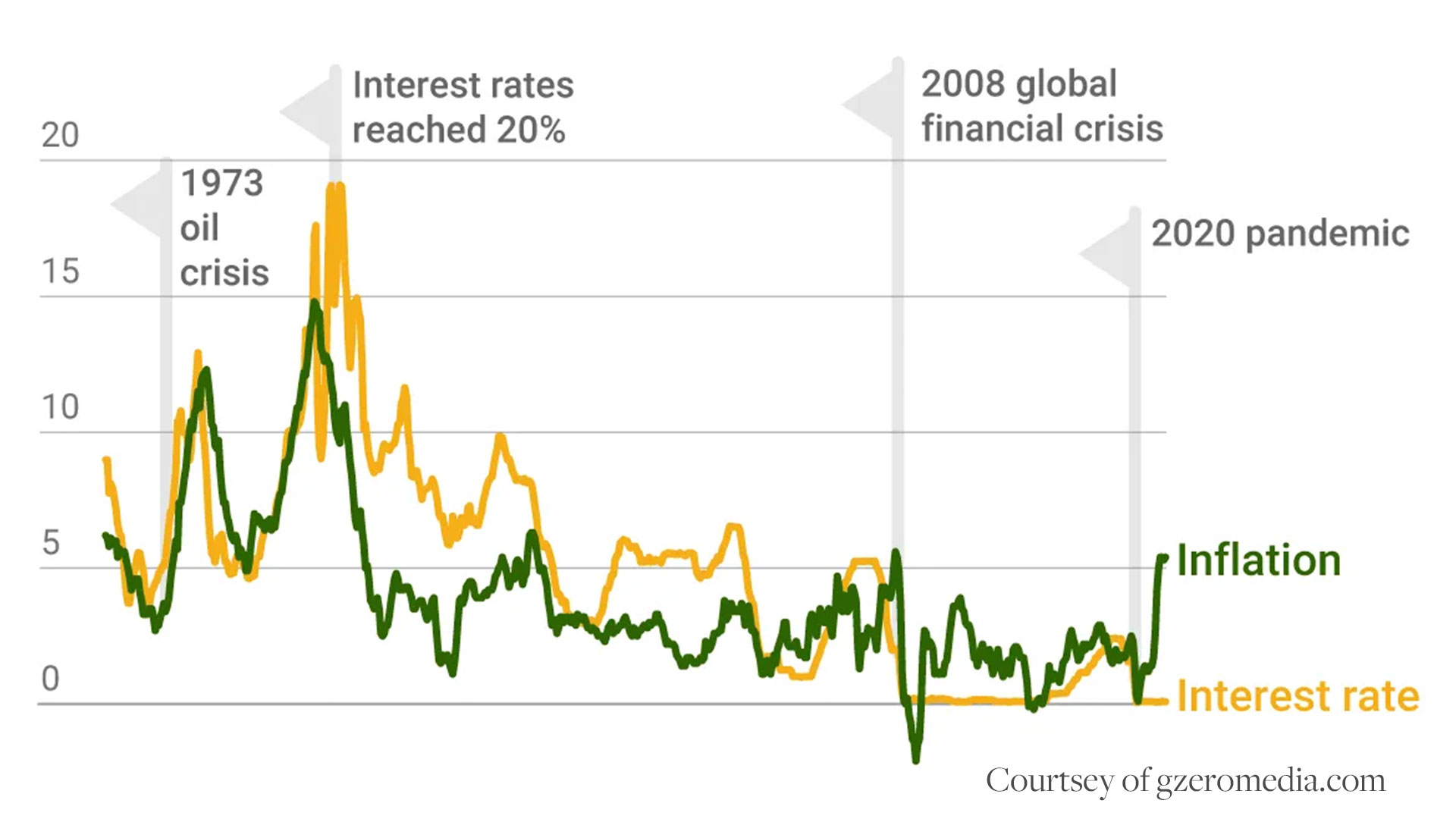

It seems as if we can't escape inflation right now, whether in our pocketbooks or in the headlines. To try to control inflation, the Federal Reserve (Fed) has begun to raise short-term interest rates. However, this doesn’t happen without creating an impact across the economy. We’ll go over how rising Fed interest rates affect home buyers and others.

As real estate buyers, sellers, and investors navigate the tumultuous market created by the current economy, there is one factor that continues to dominate the conversation: The Federal Interest Rate. This number offers insight into how much money lenders can loan out and in turn affects your abilities to buy or sell a home, get mortgages, refinance loans, and more.

Understanding why this rate matters to you as a buyer/seller of real estate is essential – not only it helps inform decision-making but also provides an opportunity to better capitalize on potential profit opportunities.

In this article, we’ll go over what exactly goes into setting the Federal Interest Rate and why understanding it should be at top of your mind for those making housing-related decisions.

Why Did The Fed Raise Interest Rates?

The Federal Reserve is facing a crucial challenge in attempting to keep long-term interest rates and inflation steady. With prices accelerating rapidly, the Fed's ability to influence them relies on its power over one thing: the federal funds rate. It remains to be seen how successful their efforts will be against this complex economic landscape.

What we have going on across the globe is the confluence of three disruptors: Supply chain issues related to economic shutdowns caused by the pandemic, more money in the economy due to COVID-19-related stimulus, and sanctions and embargoes on Russian oil because of the war in Ukraine.

As a means of controlling inflation, the U.S. central bank raises overnight borrowing rates between banks - known as the federal funds rate- making an impact on interest costs for all types of borrowers alike. Although increases may be small in percentage points, they can have significant implications when it comes to high loan amounts.

When rates go up, they can do so more than once and often do. The federal funds rate has increased three times in 2022, rising 1.5% so far. This puts it in a range of 1.5% – 1.75%.

The Fed must balance a desire to control inflation with the negative impacts it can have on the economy. The idea of these rate hikes is to make it more expensive for people to borrow money, which slows down spending. If demand drops, the theory goes, sellers will lower or keep a lid on prices until demand comes back.

However, the other thing low-interest rates help with is business expansion. Low-interest rates are often key to business expansion, which in turn can contribute to maximum employment. When access to funds is made more attainable, businesses have greater opportunities for growth and the ability to hire more people - fueling a healthy economy. If rate increases occur too quickly, however, demand may decrease leading employers lay off workers resulting in an economic downturn that works against the Fed's objectives of creating conditions favorable job seekers nationwide.

If people aren’t spending and they’re losing their jobs, this can lead directly to a recession. Although the economy tends to go in cycles, this is something every Fed chairperson wants to avoid. For this reason, while there’s theoretically no limit to how many times the Fed can raise rates, it’s a delicate balancing act.

How Short-Term Interest Rates Are Determined

Central banks play a critical role in determining short-term interest rates and creating economic stability. Through careful observation, governments craft policies to maintain appropriate levels of money supply within the economy – too much or too little can cause chaos with prices either soaring or crashing. This policy requires continuous monitoring for optimal results.

If the monetary policymakers wish to decrease the money supply, they will raise the interest rate, making it more attractive to deposit funds and reduce borrowing from the central bank. Conversely, if the central bank wishes to increase the money supply, it will decrease the interest rate, which makes it more attractive to borrow and spend money.

The federal funds rate is the rate banks charge each other for overnight loans. It also affects the prime rate—the rate banks charge their best customers, many of whom have the highest credit rating possible.

How Long-Term Interest Rates are Determined

Interest rates on mortgages and other loans don't necessarily have to adhere to the Fed Funds rate. Rather, their motions are dependent upon the demand for 10- or 30-year Treasury notes released by the US Treasury Department during auctions - lower demands result in higher interest yields, while high demands can take them down a notch.

If you have a long-term fixed-rate mortgage, car loan, student loan, or any similar non-revolving consumer credit product, this is where it falls. Some credit card annual percentage rates are also affected by these notes. These rates are generally lower than most revolving credit products but are higher than the prime rate.

How The Federal Reserve Affects Home Buyers

When the Federal Reserve raises the federal funds rate, it tends to lead to higher interest rates across the economy. Mortgage rates are no exception. Let’s take the next few sections to see how this rate increases impact buyers, sellers, and homeowners looking to refinance.

Although mortgage rates and the federal funds rate aren’t directly correlated, they do tend to follow the same general direction. Therefore, a higher federal funds rate means higher mortgage rates for buyers. This has several effects:

‣ You wind up qualifying for a lower loan amount. The amount of preapproval from lenders is based on both your down payment and the monthly payment you can afford based on your debt-to-income ratio (DTI). Because your monthly payment is higher, you’ll have a lower loan amount you can handle. This could particularly impact first-time buyers because they don’t have the money from the sale of a home to offset a lower loan amount with a higher down payment.

‣ You may have difficulty finding homes in your price range. As rates rise, sellers typically end up not raising prices and may even lower them if they don’t receive offers after a period, but it’s important to realize that this may not happen right away. Right now, there’s not enough inventory on the housing market to keep up with supply, particularly when it comes to existing homes. For this reason, pent-up demand could sustain higher prices for quite a while. Some buyers may be temporarily priced out of the market.

‣ Higher rates mean higher mortgage payments. This would mean spending a bigger chunk of your monthly budget on your house.

‣ You should carefully weigh buying vs. renting. Typically, with property values going up as fast as they are, the cost of rent goes up faster than mortgage payments, even with higher rates. However, every market is different, so it doesn’t hurt to do the math for your area.

How The Federal Reserve Affects Home Sellers

If you’re looking to sell your home, you may feel now is the time given that home prices have risen 21.23% this year, according to the Case-Shiller 20-city index at the time of this writing. As rates go up, there are several things you need to consider:

‣ There may be fewer interested buyers. Higher rates mean more people could be priced out of the current market. Because of this, it could take longer for offers to roll in on your home and you may have to wait a while for it to sell.

‣ You might have a harder time finding a new home. One of the things that make your home so desirable and drive home prices up as a seller is the fact that there are so few options on the market. What you need to realize is that even if you make a bundle on your home, you could end up spending a lot more to find another house. You would also be doing so at a higher interest rate.

‣ Your home may not sell for as much. This is the part that’s hardest to predict because inventory is so limited that prices will remain high in many areas for longer than they normally would in a rising-rate environment. However, at some point, the frenzy for housing will end. When that happens, you might have to lower your price to get offers.

But wait, what does it mean for current Homeowners?

If you're a homeowner, the way you are affected by the federal funds rate increase depends on the type of mortgage you have and what your goals are. Let's run through three different scenarios.

If you have a fixed-rate mortgage and you do nothing with it, your rate won’t change at all. In fact, the only thing that can change your payment is a fluctuation in taxes and insurance.

If you have an adjustable-rate mortgage, chances are pretty good that your rate will be going up if the rate is due for an adjustment. Of course, whether this happens and by how much is dependent on caps in your mortgage contract and how far your current rate is from market rates when the adjustment takes place.

If you’re looking at refinancing, you should know that if you’ve taken out a new mortgage at any time in the last several years, you probably won’t be getting a lower rate. However, one thing to keep top of mind in this type of market is that years of rising prices mean that many people have a lot of equity. This could work to your advantage in debt consolidation, for example.

When the Federal Reserve raises the federal funds rate, interest rates tend to go up everywhere. While no one likes higher mortgage rates, they’ll always be lower than the interest rate you could get on a credit card. Debt consolidation could allow you to roll high-interest debt into your mortgage and pay it off at a much lower rate.

What Current Home Buyers Should Do Now

Life's circumstances can sometimes compel us to make quick decisions about buying a home, even if the market doesn't seem favorable. Whether it be an ever-growing family or career opportunities that demand relocation, we may find ourselves needing more space and investing in property despite external conditions.

You shouldn’t despair just because rates are on the rise if you’re a home buyer. There are several things you can do to make sure you’re prepared to meet any challenge the housing market can throw at you.

Get Your Finances in Order by Paying down existing debt. DTI is the key metric that lenders look at when determining what you can afford for a monthly payment. It’s a direct function of your income compared to the amount you spend every month making required debt payments. Neither is easy, but it can be easier to pay off debts than miraculously start making more money. If you’re trying to make the most impact on your DTI, pay off the debts with the biggest monthly payments first. If you are further out from buying a home, you may opt to pay off the debts with the highest interest rates first.

Improve your credit score. Your credit score is often a reflection of your financial responsibility, as lenders use it to gauge how well you manage debt. The higher the number, the better - which can be achieved by making consistent and timely payments on debts and using less-than-30% utilization for any revolving lines of credit.

Build your savings for a down payment. Building your savings for a down payment can be the difference between an optimal interest rate and one that could cause you to lose valuable funds. Establishing larger amounts of equity in the form of a higher initial down payment goes far in reducing lender risk, resulting in a lower interest rate.

Look for ways to trim your budget. Finding small ways to cut back can make it easier to pay down existing debts as we discussed above and save for your down payment.

What To Remember if You are Looking to Buy or Sell a Home

The Federal Reserve increases the federal funds rate in order to try to get inflation under control. Although not directly correlated with higher mortgage rates, they do tend to move in the same direction.

If you’re an existing homeowner, whether this impacts you depends on the type of mortgage you have. Those with a fixed rate need not worry. If your ARM is scheduled to adjust, the rate is probably going up.

If you’re a home buyer, rising rates have a negative impact on how much you can afford. The good news is that home prices tend to go down as rates rise. The bad news is that it may not happen as quickly this time around because there’s an acute shortage of inventory.

The other important thing to keep in mind is that mortgage rates don’t exist in a vacuum. If they’re going up, so is every other consumer interest rate. This could make now a good time to do a debt consolidation by using your home equity to pull cash out.

Categories

Recent Posts

Stahley Thompson Homes of TTR Sotheby's International Realty

Since 2010, the real estate advisors at Stahley Thompson Homes have ranked among the highest performing in the region, and are regarded for their integrity, professional service, and community leadership. The team produces extraordinary results for clients by leveraging proprietary global marketing, cutting-edge digital strategies, and the power of local expertise. Truly, this is the quintessential real estate brand.