2023 Annapolis Real Estate Market Outlook

As you prepare for the year ahead, Stahley Thompson Homes of TTR Sotheby’s International Realty is here to guide your journey through an ever-evolving real estate landscape. This 2023 Real Estate Outlook offers insight into navigating this dynamic market with confidence and success.

Despite expectations of declining prices based on market trends, luxury home values remained consistent in 2022. This fascinating trend suggests that the current housing landscape is being shaped by factors other than cost and availability alone.

There are numerous factors that have led to resilient price performance in the market. First, the world’s seen a surge in wealth creation in recent years and the affluent still have more money to spend. Many luxury purchases are made in cash, so the high-end sector remains somewhat insulated from interest-rate fluctuations.

As a result of the changes brought by Covid-19, more and more individuals are investing time in creating an inspirational living space – with home life taking center stage even as restrictions have eased. This has become an essential aspect of many people's lifestyles that is here to stay.

What that means is luxury homeowners can rationalize the expenses of owning multiple properties since they are spending more time in them and are therefore less likely to put them up for sale. As such, inventory continues to be low coupled with an undersupply of new construction.

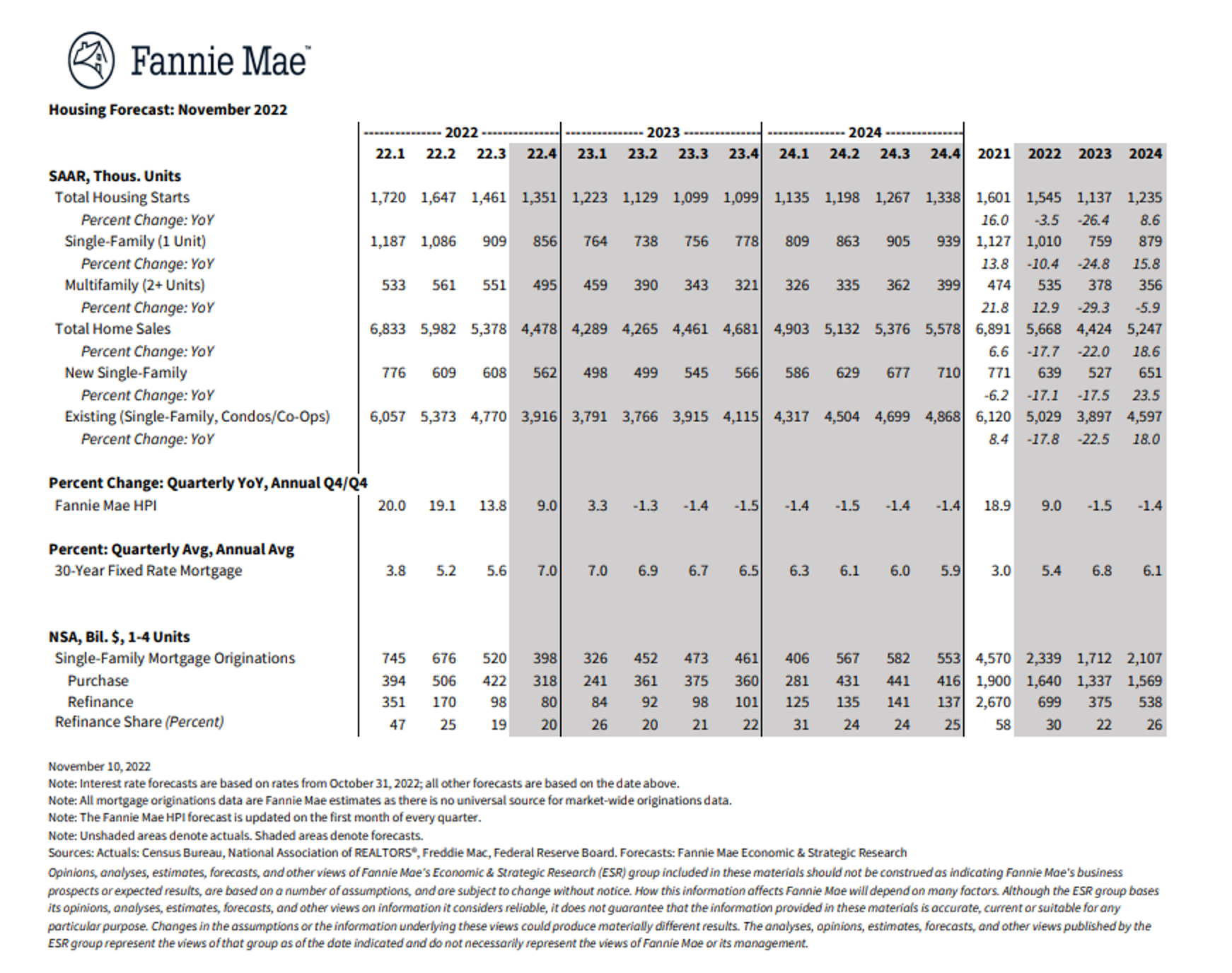

Fannie Mae’s November 2022 forecast predicted that home sales will decline but begin to rebound in 2024. Fannie Mae economists also believe mortgage rates will steadily fall, but likely not drop below 6% any time soon. Despite this, we have remained busy brokering deals for our clients, many of whom are looking to make opportunistic investments during a fluctuating market.

2023 will be the year of trends beyond the real estate sector, from sustainable luxury items to record-breaking auction sales to luxury goods investments. Now more than ever, we know that the affluent want to spend their equity wisely, and we’re here to help them do just that.

The biggest issue to watch across the real estate market in 2023 is inventory, especially in dynamic markets like ours in Annapolis and Washington D.C. In some cases, there’s only a one-month supply, whereas six months is considered equilibrium. This lack of new inventory in the upper end of the market is overshadowing concerns about inflation and higher interest rates.

Keep in mind that there is a correlation between the high-end real estate sector and the stock market. High-interest rates often affect corporate earnings and as a result, the stock market. In Silicon Valley, for example, a lot of tech start-ups aren’t performing well, so people are not buying as much at the top.

One question we are often asked is could the luxury market be insulated from some of the slowdown in the overall market? In our view, the luxury market has always led us out of difficult cycles and down markets. The higher-end market tends to be insulated. Buyers are still engaged and asking agents to tell them when something interesting comes on the market so they can act quickly if needed.

There’s a bit of a divide between sellers and buyers. Home sellers want those multiple bids of the past two years, and buyers are seeing the stock market’s challenges and want a good deal. Fannie Mae projects home price declines of 1.5% in 2023, however, pricing is not an exact science.

2023 will see several factors affecting the general and high-end market. Interest rates impact everything in one way or another, especially confidence in the market. Inventory is another factor. There likely won't be a significant unlocking of supply since few sellers will let go of their properties, creating a lock-in effect. Yet the structure of the overall housing market is very different today from previous years due to an overwhelming number of mortgages that have a fixed rate versus previous years where many had adjustable rates.

In terms of new construction, builders were proactive following the pandemic by building single-family homes. In fact, single-family renters have become another pillar of housing. However, building houses is hard, too, because of supply-chain issues and materials affordability.

These factors may affect the second-home market. It’s nothing to be alarmed about, but it can be a shock to the system because 2021 was such a historic year for real estate.

If you are interested in discussing how these trends may impact your city or potential transaction, contact one of our real estate advisors today.

Categories

Recent Posts

Stahley Thompson Homes of TTR Sotheby's International Realty

Since 2010, the real estate advisors at Stahley Thompson Homes have ranked among the highest performing in the region, and are regarded for their integrity, professional service, and community leadership. The team produces extraordinary results for clients by leveraging proprietary global marketing, cutting-edge digital strategies, and the power of local expertise. Truly, this is the quintessential real estate brand.